Thai SEC Proposes Regulations for Crypto Investment in Mutual, Private Funds

Bitcoin ETF

Thailand

Thailand SEC

Mutual, private funds will be allowed to invest in crypto ETFs.

Last updated:

October 10, 2024 03:22 EDT

Author

Sujha Sundararajan

Author

Sujha Sundararajan

About Author

Sujha has been recognised as Women In Crypto 2024 by BeInCrypto for her leadership in crypto journalism.

Author Profile

Share

Copied

Last updated:

October 10, 2024 03:22 EDT

Why Trust Cryptonews

With over a decade of crypto coverage, Cryptonews delivers authoritative insights you can rely on. Our veteran team of journalists and analysts combines in-depth market knowledge with hands-on testing of blockchain technologies. We maintain strict

editorial standards

, ensuring factual accuracy and impartial reporting on both established cryptocurrencies and emerging projects. Our longstanding presence in the industry and commitment to quality journalism make Cryptonews a trusted source in the dynamic world of digital assets.

Read more about Cryptonews

Wat Phra Kaew, Emerald Buddha temple, Wat Phra Kaew is one of Bangkok’s most famous tourist sites

Thailand’s Securities and Exchange Commission (SEC) has proposed draft regulations allowing mutual and private funds to invest in cryptos.

The proposed principle,

announced Wednesday

, is currently seeking public feedback on revisions to mutual funds’ investment criteria in digital assets.

The move comes at a time when interest in cryptocurrency investment is increasing. Thailand, one of the world’s most crypto-friendly nations,

ranks 10th globally in terms of adoption

.

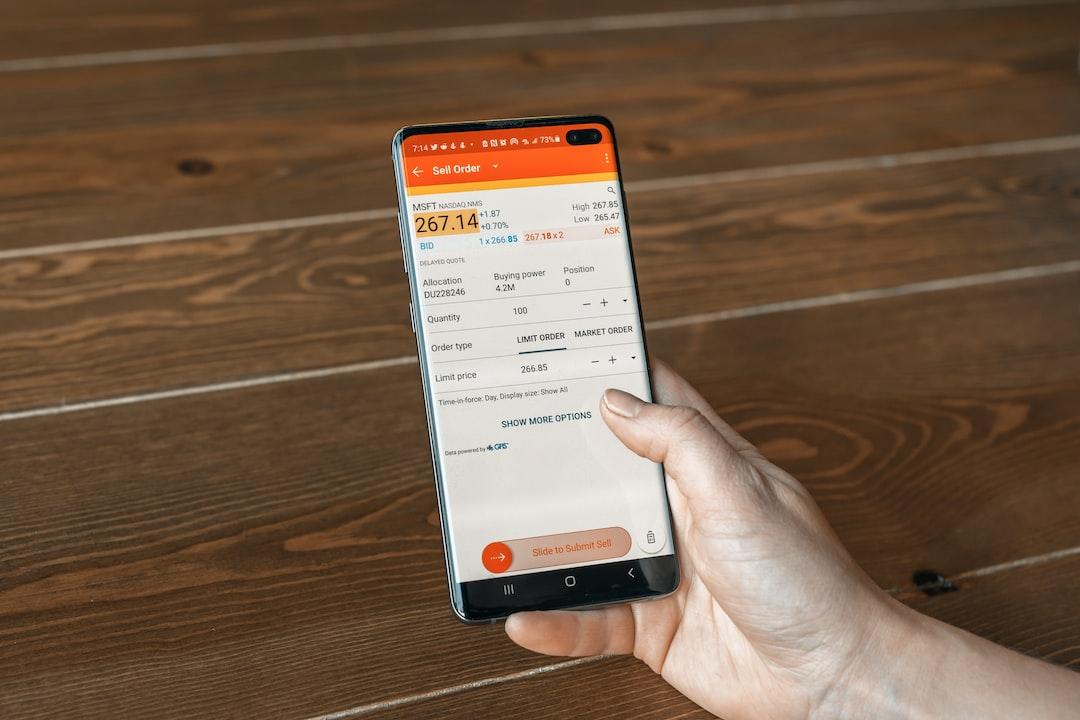

The regulator noted that the funds will be allowed to invest in crypto exchange-traded funds (ETFs) listed on the US exchanges. Further, it also allows funds to choose investment tokens, which has attracted the interest of Thai investors.

“The funds will be allowed to invest in investment tokens subject to current investment limits of traditional securities, such as single entity limit, group limit, and concentration limit.”

The announcement read that for institutional investors and ultra-high-net-worth individuals with high-risk tolerance, the funds will be allowed to invest in crypto ETFs with no investment limit.

Thai SEC deputy secretary-general Anek Yooyuen said that investment tokens will have the same investment ratios as transferable securities. This is because they have key risks and features similar to traditional securities, such as debt securities,

Bangkok Post

reported.

“Relevant criteria will be revised to support the establishment and management of funds investing in digital assets, such as asset custody, digital asset value calculation, information disclosure and appropriate advertising.”

Thailand

approved its first crypto ETF

in June, issued by One Asset Management (ONEAM). The Thai SEC endorsed ONEAM’s Bitcoin ETF, marking a milestone in the country’s evolving regulatory framework for digital assets.

Thai SEC Mulls Initial Coin Offering, Increase Penalties for Violating Crypto Firms

Additionally, the regulator is also considering allowing authorised initial coin offering portals to use outsourced companies.

“This measure was endorsed by the SEC and a public hearing is needed before it can be implemented,” Yooyuen added.

Besides, the Thai SEC will also allow 10 private companies to explore trials for exchanging cryptos for Thai bhat as a part of

digital asset regulatory sandbox project

.

Furthermore, crypto firms that violate the SEC rules are considered a severe offence. As a result, the regulator aims to increase penalties for such companies in addition to their licenses being revoked.

Securities firms that send inappropriate trading orders will be fined a maximum of 1 million to 3 million baht. Investors who breach laws by manipulating stocks are subject to civil and criminal penalties, the report noted.

Follow us on Google News