Pantera Capital, the pioneering cryptocurrency fund in the United States, has successfully secured a portion of the 41 million locked Solana tokens in an auction held by FTX, according to Bloomberg. The auction saw the sale of 2,000 SOL tokens this week, with Pantera Capital emerging as one of the winning bidders.

FTX, once a prominent cryptocurrency exchange, declared bankruptcy in 2022, resulting in its crypto holdings being locked. The majority of these holdings consisted of Solana (SOL) tokens, which were slated for liquidation.

These SOL tokens are subject to a pre-agreed vesting period, preventing them from being traded on the market immediately. However, over the next four years, they will gradually become accessible.

Institutional investors have shown a strong interest in these SOL tokens, as they see an opportunity to acquire Solana at a discounted price. Pantera Capital, a US hedge fund and venture capital firm managing $5.2 billion in digital assets, is particularly keen on participating in this opportunity.

Since March, Pantera has been raising funds to establish a fund specifically for purchasing up to $250 million worth of locked Solana from the estate. Their efforts have paid off, as they were able to acquire some of the $2.9 billion worth of SOL sold earlier this month, alongside Galaxy Digital, at a price of $64 each. This price is significantly lower than the trading price of $178 at that time.

It is worth noting, however, that the tokens were sold at a higher price compared to the previous auction. The exact price has not been disclosed by the Bloomberg source, but it will be made public once the sale information is released.

The FTX estate auction has caused a stir in the crypto market, raising concerns about FTX’s ability to repay its debts and sparking allegations of violations of creditor rights.

The four-year lock-up period for the sale has led to dissatisfaction and impacted Solana’s market stability, shining a light on the volatility and risks associated with cryptocurrency investments.

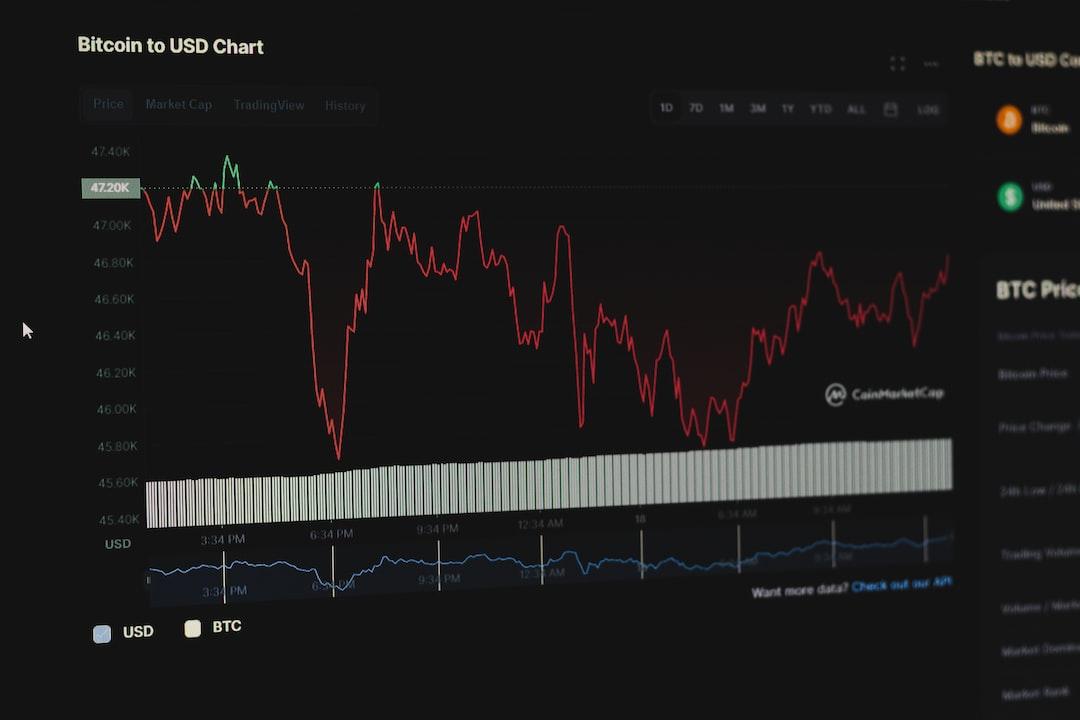

Following the report, there has been a negative sentiment surrounding Solana, resulting in a 2.3% price retracement since its publication. Further decline is possible as the complete sale information has yet to be made public.

However, some view this news as a positive indicator for Solana’s future, as major players in the industry are showing renewed confidence in its long-term performance.